Thank you TaxSlayer for sponsoring this post. Get simple pricing with no surprises when you e-file with TaxSlayer this tax season!

Lets be honest! Just saying the word “taxes” can bring on some anxiety and stress, especially if you have complex tax needs, but I bring good news, it doesn’t have to be that way. I was in that place a few years ago, I was newly married, a freelance blogger, and then when I finally had those tax situations down, we added our daughter to our family. Taxes can get complex quickly, but that doesn’t mean they are impossible! Knowledge is key and I am here to share a few blogger tax prep tips with you today. I, of course, am no expert, but I can share my experience with you and I hope that it helps you.

Lets be honest! Just saying the word “taxes” can bring on some anxiety and stress, especially if you have complex tax needs, but I bring good news, it doesn’t have to be that way. I was in that place a few years ago, I was newly married, a freelance blogger, and then when I finally had those tax situations down, we added our daughter to our family. Taxes can get complex quickly, but that doesn’t mean they are impossible! Knowledge is key and I am here to share a few blogger tax prep tips with you today. I, of course, am no expert, but I can share my experience with you and I hope that it helps you.

Do Your Research

First things first, do your research. There are tons of books and resources out there that will help you know what you can write off as a blogger. I know that I write off my hosting fees, blog post supplies for sponsored posts, my office space, and any food from business meetings just to name a few. I also write of my miles to and from the store for blog post supplies. There are lots of different things you can write off to help your tax bill, so be sure that you are informed accurately.

Create Tracking

Create Tracking

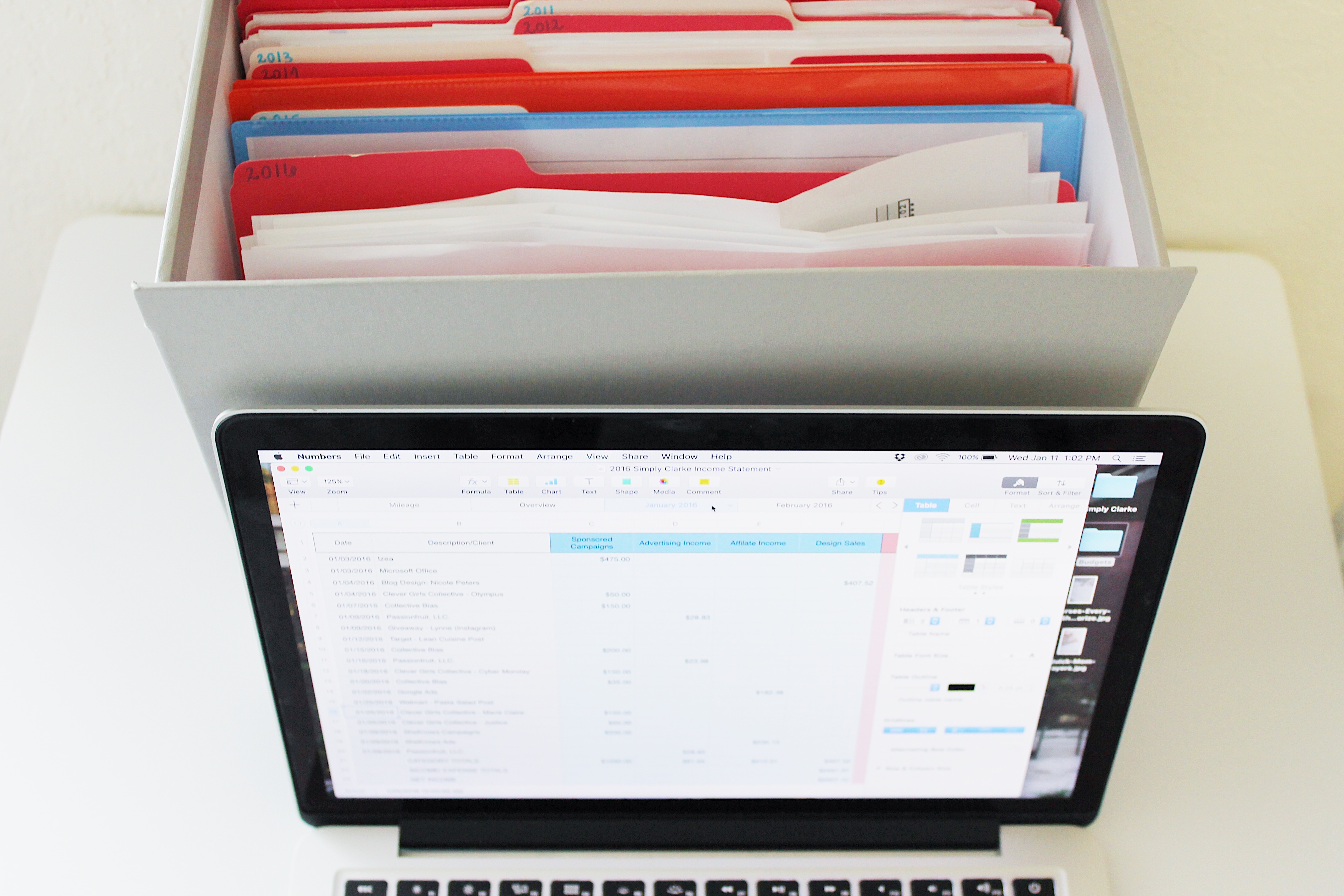

Next, you need a way to keep track of your income and expenses for your blog. I use an excel sheet I set up that has different columns for income and expenses. I track my income from sponsored posts, ad networks, affiliate networks and freelance creative jobs in separate columns just so that I can see how much I make from each. Then, I track my expenses by advertising, hosting fees, continuing education, supplies, and food business. Breaking these expense categories down help me when it comes time to separate them out when filing.

Keep Your Receipts

Keep Your Receipts

Always, always, always keep your receipts. I have a filing cabinet with folders I use for filing and I keep all of my receipts for the year in a folder. This way, I can easily find a receipt if I need it and I will have it for any reason. I am planning on keeping my blog receipts for five years just in case.

E-File with TaxSlayer

Finally, it’s time to file! With over 50 years of tax preparation experience, TaxSlayer helps you navigate your complex tax needs so that you can file your taxes on your own. They also offer free live phone and e-mail support to all customers. It is simple, transparent and such a good value. Be sure to check them out and file NOW at TaxSlayer.com!

I was selected for this opportunity as a member of CLEVER and the content and opinions expressed here are all my own.