Want a no hassle, easy, FREE way to do your taxes? Look no further. Yes, its that time again! Tax Season is upon us and lets face it, no one really loves paying taxes or going through the process of filing them. I am by no means a professional on taxes, but I will share with you a few tips that help keep me organized and make filing my taxes a breeze!

Here are my Tax Tips for Bloggers: First off, start NOW for next year! Last year around this time, I created a simple spreadsheet (I will tell you more about this later) that I used for keeping track of my blogging income and expenses. If you earn over $400 in net profit (income minus expenses) from your blog, you need to file self employment taxes. If you are one of the lucky ones that fit in this category, you will need to track your income and expenses for the year. Keep in mind, no receipt = no expense. Make sure you keep proper documentation of everything.

This where my trusty spreadsheet comes in handy. It has a space for all of my income categories, expense categories and a place for descriptions/notes, so I can track each expense/income. I highly suggest setting this up so that you can easily few each month of the year. It is also important to be informed of what an “expense” really is in relation to what you can “deduct” from your taxes. You wan to make sure each expense you are recording is appropriate. Here are a few examples:

Home Office: If you use part of your home as an office, you can deduct part of your mortgage interest, utilities (electricity, internet, phone), computer costs, etc that are used for your blog

Supplies: Supplies used in blog posts, photo props, office supplies, software, camera, etc

Advertising/Maintenance: Ads on other blogs, business cards, site design, maintenance, hosting, etc

Continuing Education: Books, e-books, conference fees, travel/expenses for conference, online courses

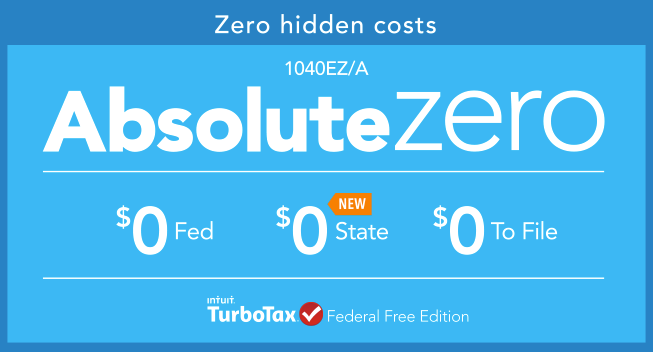

& PART TWO: Filing your taxes for FREE!!! Yep, Absolute Zero cost to you.

You can do this through TurboTax Absolute Zero Offer.

What is Absolute Zero?:

What does $0 Fed $0 State $0 To File really mean?

It means you pay absolutely nothing to file your taxes—from start to finish. For the first time ever, Americans can file both their federal 1040A or 1040EZ returns, as well as their state returns, for absolutely $0 with TurboTax Federal Free Edition. TurboTax is offering the 60 million hard-working Americans who file a simple tax return, a much-needed break. That is why is is ABSOLUTELY FREE.

What do I get with Absolute Zero?

You’re getting last year’s very popular Federal Free Edition with even more new free features. So, in addition to not paying for super-easy state and federal prep, we don’t charge you for any of these features:

- Claim the Earned Income Credit ($2,300 2013 IRS average) $0

- Cover any Affordable Care Act forms

- Find possible government benefits up to $2,000

- Get a head start by importing your W-2 $0

- Have expert product and audit support $0

- Taxpayers with an adjusted gross income of $31,000 or less, active military personnel with adjusted gross income of $60,000 or less or those who qualify for the Earned Income Tax credit can prepare and file their federal and state tax return with this option

TurboTax really does make things so simple and enables the average person to take control of their own taxes. And, TurboTax even helped us claim things we had no idea we could! Do you file your taxes at home? Have you ever used TurboTax? I would love to hear from you!

I was selected for this opportunity as a member of Clever Girls and the content and opinions expressed here are all my own.

Check out this month’s featured sponsor:

Paige @ Reasons to Come Home

Pinning this! We actually have someone who does our taxes but the spreadsheet is great for keeping up with a growing blog!